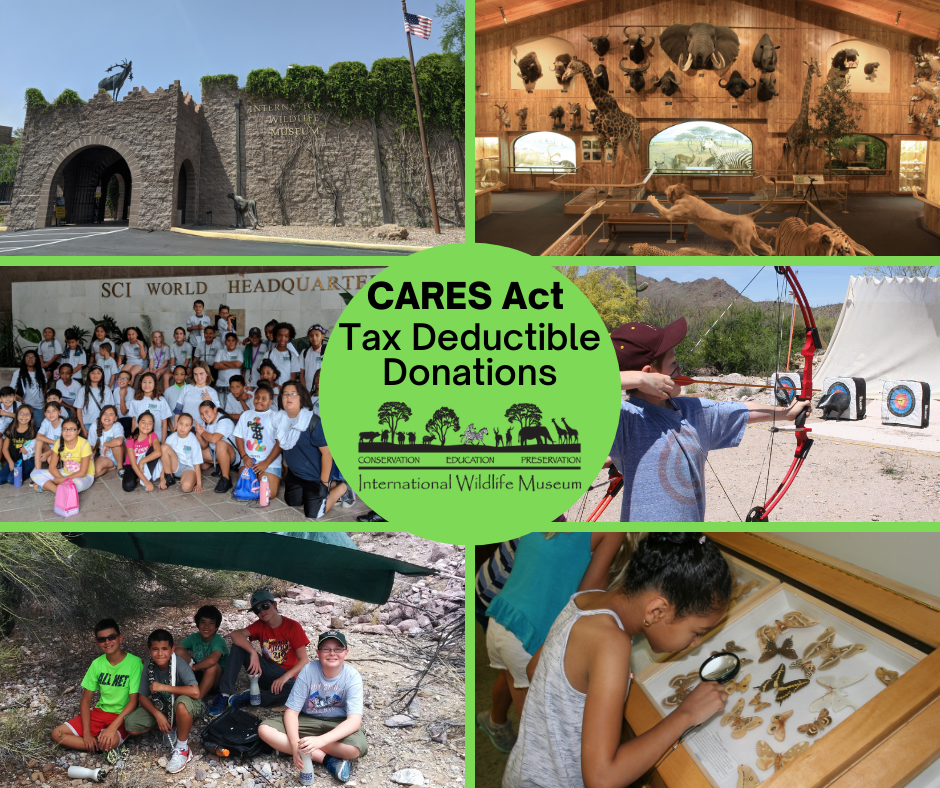

Support the future of wildlife conservation education by making a tax-deductible donation to SCIF’s International Wildlife Museum! The Museum is located in Tucson, Arizona and is dedicated to increasing knowledge and appreciation of the diverse wildlife of the world as well as explaining the role of wildlife management in conservation. Your donation helps fund our youth education programs as well as exhibit enhancements and improvements.

Around 48,000 people visit the International Wildlife Museum each year, with about half of those being children. Visitors are introduced to the North American Model of Wildlife Conservation starting in the first room of the museum with journey through Teddy Roosevelt’s life and accomplishments for wildlife. As they tour through the museum, learning about wildlife biology and conservation issues, they are also learning about the ongoing conservation projects SCIF funds all over the world, seeing how sportsmen and women’s dollars are put to work.

It is so important that you help us continue our mission of educating today’s youth on the role of wildlife management in conservation. This year, under the CARES Act, you can donate up to $300 per taxpayer ($600 for a married couple) in annual charitable contributions for tax year 2020. This is available to people who take the standard deduction and is an “above the line” adjustment to income that will reduce a donor’s adjusted gross income (AGI), and thereby reduce taxable income. As a qualifying 501(c)3 you can make a charitable donation to the International Wildlife Museum and it’s a win-win situation! The museum will benefit from your donation and you will owe less taxes in 2021! The window for taking advantage of these changes closes on December 31, 2020.

Here are three easy ways to donate:

- Visit thewildlifemuseum.org and click on the Donate button

- Mail a donation check to:

International Wildlife Museum

4800 W. Gates Pass Rd.

Tucson, AZ 85745 - Call (520)629-0100 ext. 478 to donate over the phone by credit card.

We thank you for your continued support of wildlife conservation education and wish you a joyous holiday season!